Companies Measure Financial Productivity Using Which of the Following Ratios

Current Ratio f-liquidity ratio. Examples include such often referred to measures as return on investment ROI.

Financial Ratios Top 28 Financial Ratios Formulas Type

The debt ratio indicates how much debt the firm is using to purchase assets.

. Common financial leverage ratios are the debt to equity ratio and the debt ratio. Blackboard Learn 10112011 115854 PM Base period Financial productivity measures Operational productivity measures Target period Question _____ isare a prior period used to set the benchmark for measuring productivity changes. As the results show advisory firms tend to level off at a threshold of about 600000 of revenue per advisor.

Nickolls Corporation has provided the following financial data The companys current ratio is closest to a037 b 042 c065 d334 Rawe Corporations accounts receivable at the end of Year 2 was 356. Financial ratios provide information about five areas of financial performance. Earnings per share of common stock Probably the measure used most widely to appraise a companys operations is earnings per share EPS of common stock.

For the ratios to have meaning they need to be compared to at least one of the following. Price-to-earnings ratio earnings per share and net profit margin. -solvencyfinancial leverage ratio EBITinterest expense.

Asset-utilization ratios measure all of the following except. Which of the following is an advantag. Explains what role the cash position of a firm plays in the financial health of a company.

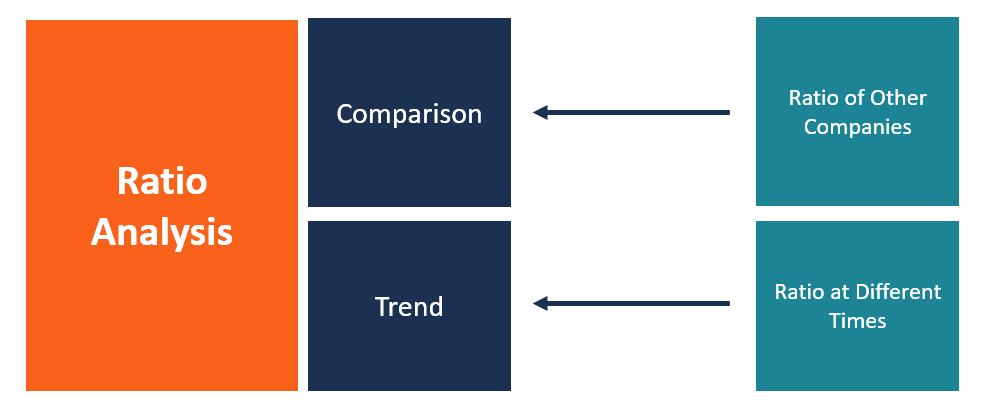

Financial ratios are relationships determined from a companys financial information and used for comparison purposes. Lets assume that a team lead at a financial services company decides to assess the level of productivity of his three newly recruited financial analysts Jason David and Henry. Productivity is the effectiveness of output.

Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations. Sales goals and profit margins are all performance metrics examples andor productivity metrics. The current ratio also known as the working capital ratio me.

A companys ability to generate cash from operations to meet its. This ratio provides insight into the solvency of the business by reflecting the ability of shareholder equity to cover all debt in the event of a business downturn. Liquidity is the ease with which a firm can.

-measures a companys ability to meet its SHORT-TERM debt obligations in a timely fashion 1 current ratio 2 quick ratioacid ratio test 3 cash ratio. Liquidity is the ability of a firm to convert its assets as quickly as possible into cash. Partial productivity measures keep managers aware of trade-offs in.

What are some of the downfalls of comparing ratios among different companies. Debt to equity refers to the amount of money and retained earnings invested in the company. An investor has been given several financial ratios for an enterprise but none of the financial reports.

Operating Cash Flow Ratio OCF Current Ratio. Cash Coverage Ratio f Def. Leverage Ratios Debt-to-equity debt-to-capital debt-to-assets and debt-to-EBITDA are examples of leverage ratios that are used to determine how much debt a company has taken out against its assets or equity.

The debt-to-equity ratio is a solvency ratio that measures how much a company finances itself using equity versus debt. How many times per year the inventory is. Include the following discussion points.

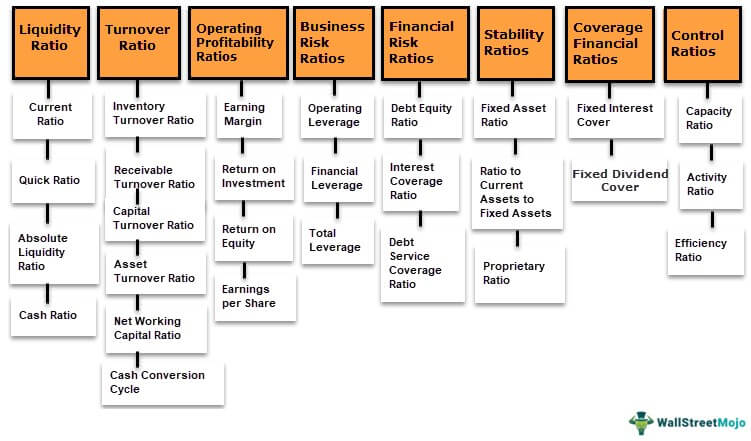

Productivity of fixed assets in terms of sales. Financial ratios are grouped into four broad categoriesliquidity safety or leverage profitability and efficiency productivity. KPIs and productivity metrics can often act as intertwining categories.

Common liquidity ratios include the following. Give an example of a single factor. They are by definition how businesses measure productivity usually that of their employees.

Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income profit relative to revenue balance sheet assets IB Manual Balance Sheet Assets Balance sheet assets are listed as accounts or items that are ordered by liquidity. The current ratioCurrent Ratio FormulaThe Current Ratio formula is Current Assets Current Liabilities. Notably though this measure includes revenue across all the advisor professionals of the firm including both seniorlead advisors and also service and support advisorsWhich means in practice many of these firms are likely supporting 12M of.

We can view liquidity in one other way in terms of the value of an asset. Single factor productivity multiple factor productivity and total factor productivity. The list below describes 30 of the most commonly used financial metrics and KPIs and you can find formulas and more information on each below.

Decides to use the no. Debt to Equity Ratio Total Debt Total Equity. Productivity ratios are important in evaluating the efficiency effectiveness and health of a person company industry or business.

The ratios of other firms of similar size in the same industry. The companys level of profitability return on shareholders. Market-to-book-value ratio and total-debt-to-total-assets ratio.

Of cases executed as the output to calculate the productivity ratio. Discuss benchmarking performance measures using the three different types of productivity ratios. Metrics are methods of measurement.

The relationship of sales on the income statement to various assets on the balance sheet. Of months in the company as the input and no. Return on Sales ROSOperating Margin.

What are Profitability Ratios. In other words it shows if the company uses debt or equity financing. Within these categories there are several financial ratios and each help you measure different aspects of your businesss productivityusing assets generating profits moving inventory and so on.

The ratio would be 4206 which indicates that for each dollar of capital invested by a common stockholder the company earned approximately 42 cents. Which combination of ratios can be used to derive return on equity. The firms historical ratios.

List of Top 5 Types of Financial Ratios. Its about having cash available as and when required.

Ratios Rule But Do You Know Which Financial Ratios To Watch Financial Ratio Medical School Stuff Financial

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Finance Investing

Profitability Ratios Calculate Margin Profits Return On Equity Roe

No comments for "Companies Measure Financial Productivity Using Which of the Following Ratios"

Post a Comment